Stay on top of your debt

Credit Card Debt Management

Year

2025

Client

Experian

Objective & Context

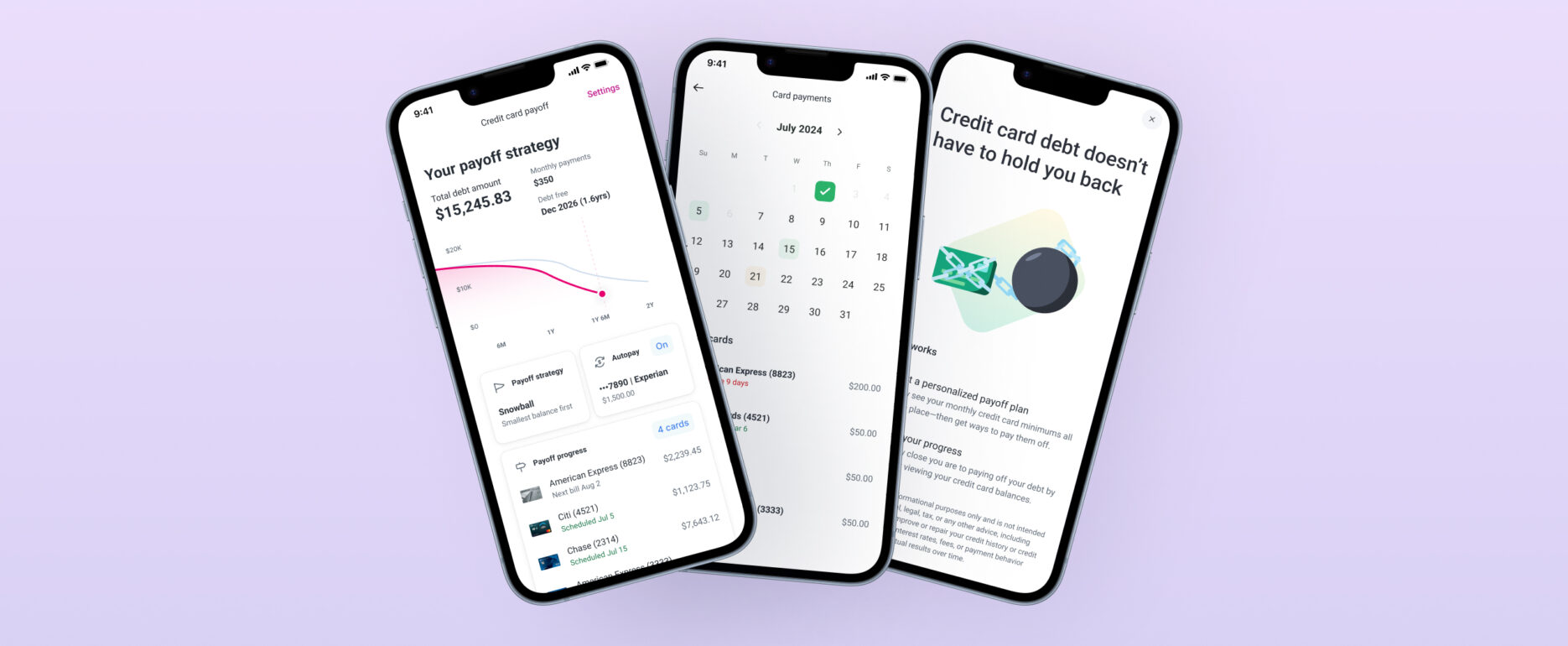

As a Senior Product Design Manager, I led the design of the Credit Card Payoff Planner, a feature within Experian’s Personal Financial Management (PFM) tool.

The goal was to help users take control of credit card debt through smart payment planning, progress visualization, and personalized recommendations.

Our mission was to make debt management approachable and rewarding, reducing anxiety while motivating users to achieve financial freedom.

Design challenges

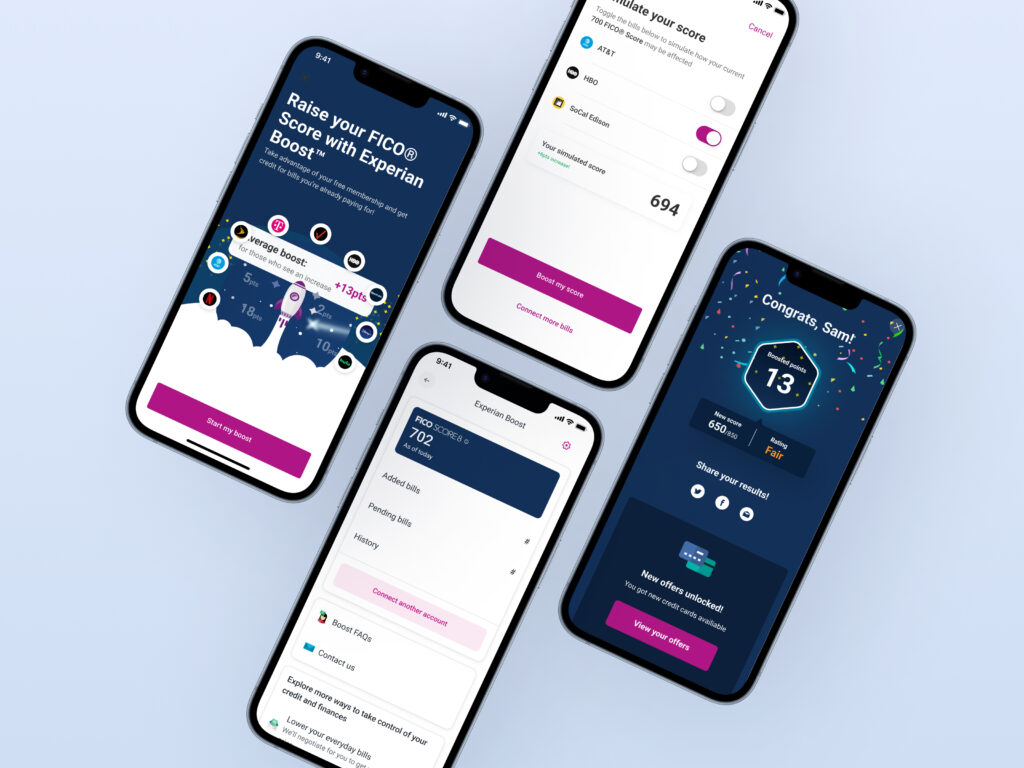

Motivation & Behavior Change

Encouraging users to stay committed to long-term payoff plans required a motivational experience. We had to balance emotional design, clear goal-setting, and small wins to sustain engagement over time.

Data Accuracy & Trust

Users were skeptical about projected payoff dates and savings estimates. Designing transparent calculations and accessible explanations was essential to build confidence and drive continued usage.

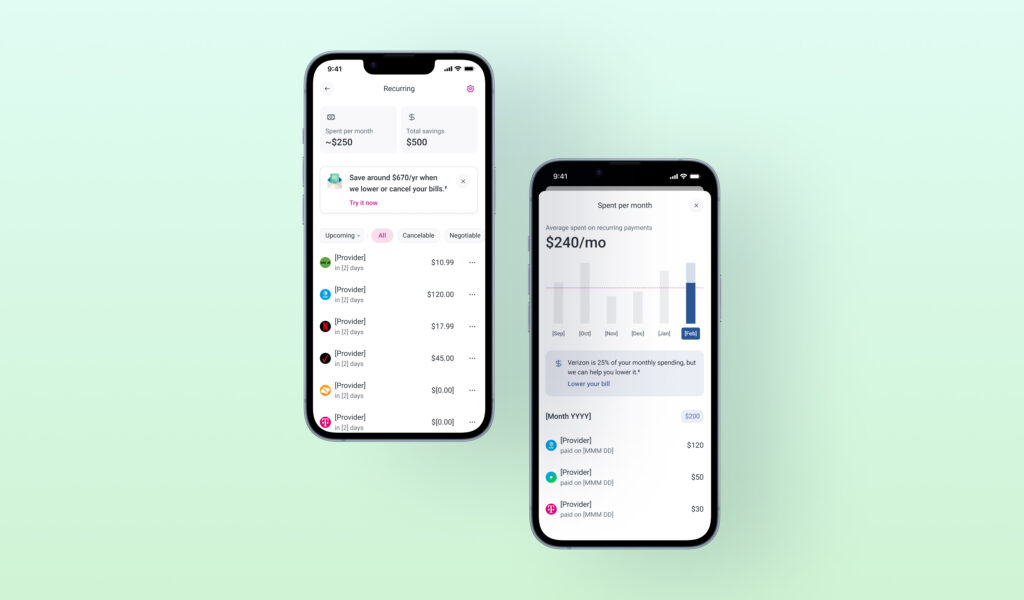

Complex Financial Inputs

Every user’s debt situation is unique — multiple cards, varying interest rates, and changing payments. The challenge was to simplify complexity into an intuitive experience that still felt precise and reliable.

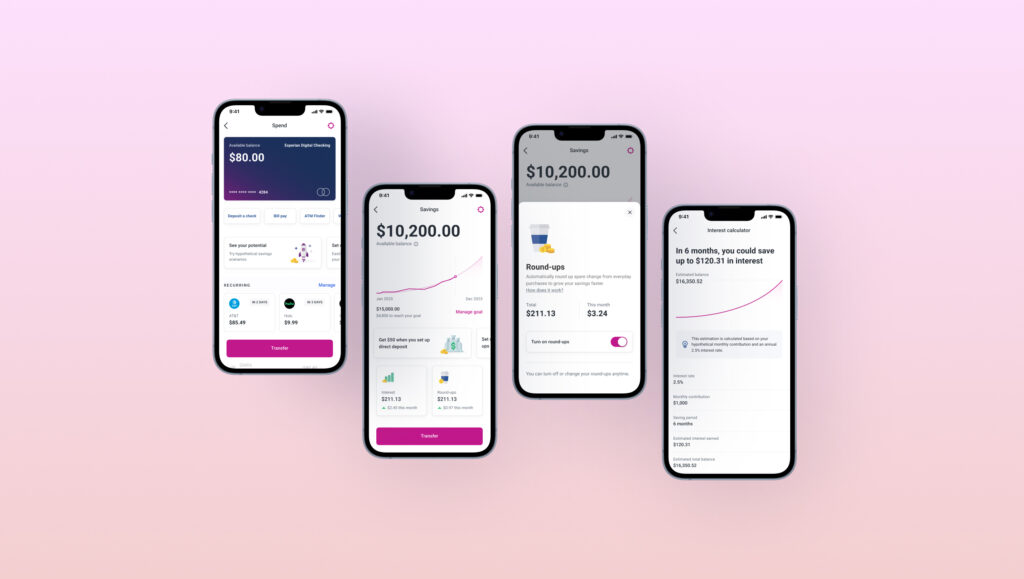

Integration with Experian’s Ecosystem

Ensuring seamless integration within Experian’s broader ecosystem (CreditHub, Smart Money, and PFM) was crucial. Users needed consistent navigation, design language, and real-time account sync.

My approach

User-Centric Discovery

Partnered with the research team to interview users with high revolving debt. Identified friction around understanding interest impact, inconsistent payments, and lack of motivation.

Data Visualization

Designed a clean, interactive progress dashboard showing debt-free timelines, monthly goals, and total interest saved. Used color and motion to emphasize milestones and progress.

Guided Payoff Strategies

Integrated payoff methods such as Avalanche and Snowball — with clear trade-offs and simulation tools for informed decisions.

Iterative Validation

Prototyped multiple versions of the progress tracker and savings estimator. Conducted usability testing to refine language, layout, and feedback moments for maximum clarity and motivation.