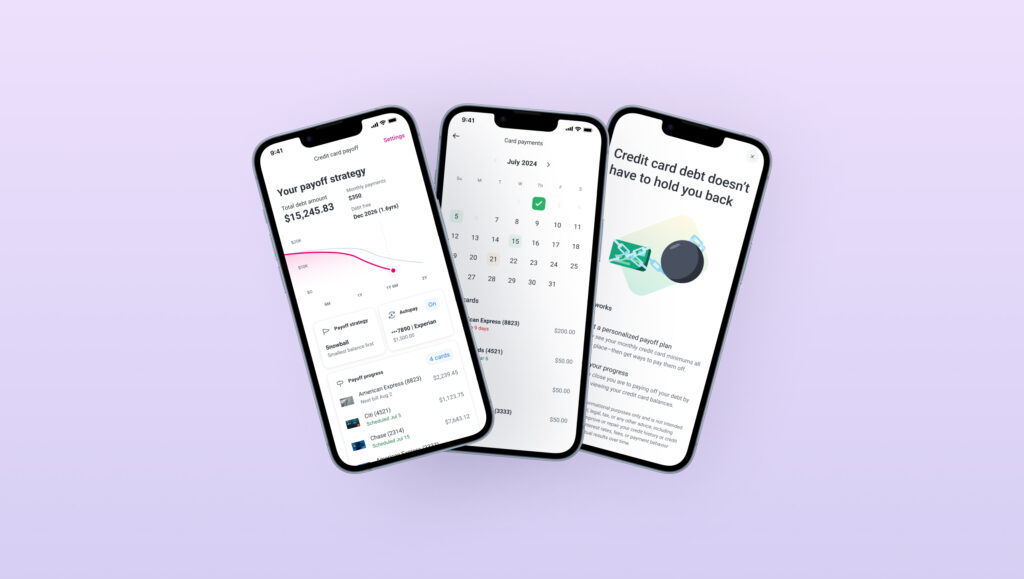

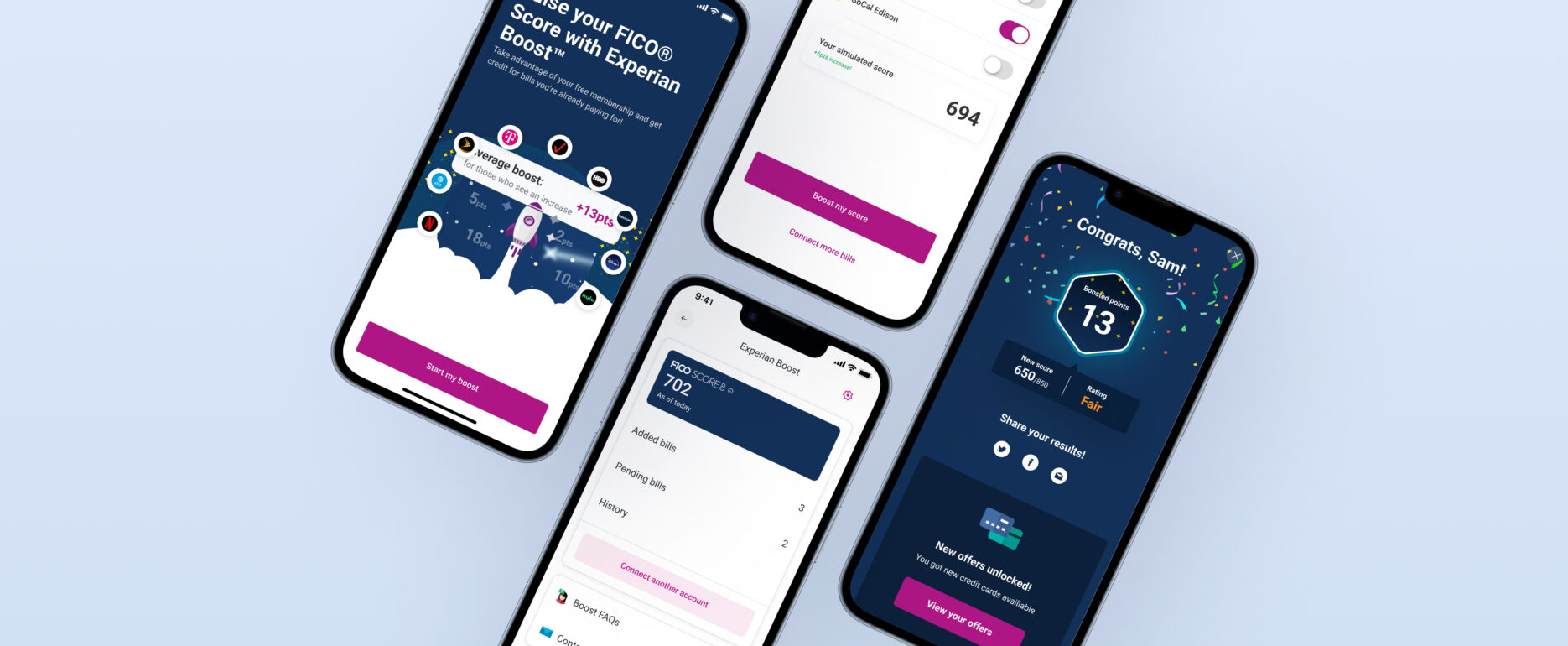

Unlocking your full credit potential

Experian Boost

Year

2024

Client

Experian

Objective & Context

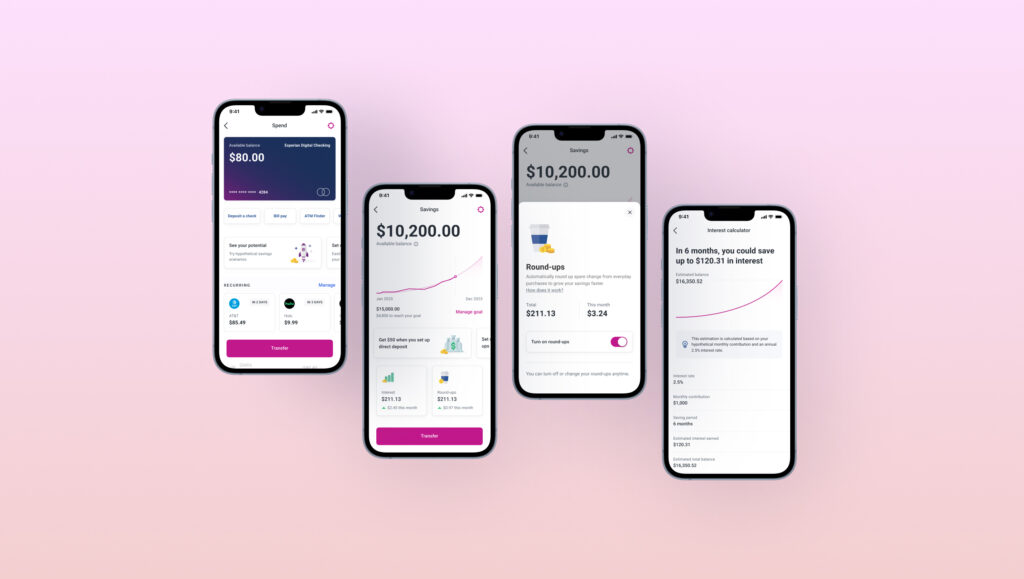

Experian Boost enables millions of users to instantly raise their FICO® Scores by adding verified payment histories from utilities, telecom, streaming services, and more. As the Senior Product Design Manager, my objective is to enhance the platform by expanding eligible payment categories, refining the user experience, and delivering financial literacy content to empower consumers in improving their credit scores.

Design challenges

Security

Streamlining complex interactions around securely linking financial accounts. Ensuring the process is intuitive and secure without sacrificing speed or user trust.

Education

Providing accessible financial literacy content without overwhelming users. Balancing comprehensive information delivery with simplicity to maintain user engagement and prevent information overload.

Tech limitations

Navigating technical limitations related to data integration. Working within existing technical constraints while striving to deliver seamless.

Integration

Ensuring seamless platform integration, intuitive navigation, and cohesive cross-feature interactions. Creating transparent, easily understandable user experiences that naturally integrate into existing user flows.

My approach

User Research & Insights:

Analyze feedback to pinpoint pain points in linking accounts and confusion around eligible payments.

Discover a demand for additional categories, such as audio streaming and rent payments

Expanding Payment Categories:

Collaborate with the Product team to identify and prioritize new eligible payment sources.

Design intuitive visual cues and straightforward messaging to highlight the expanded payment options.

User Experience Refinement:

Simplify the onboarding process, reducing friction and drop-off rates during account linkage.

Implement personalized recommendations and insights to encourage users to add more payments and improve their scores.

Financial Literacy Integration:

Develop bite-sized educational modules seamlessly integrated into the user journey, increasing user confidence.

Create interactive simulation tools demonstrating how specific actions could affect credit scores