Build credit without debt

Experian Smart Money

Year

2023

Client

Experian

Objective & Context

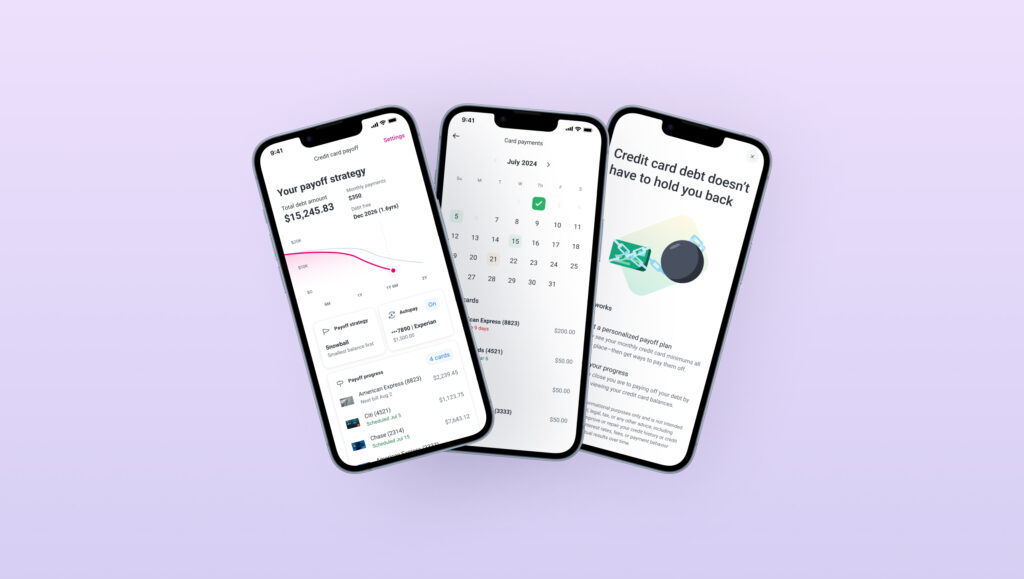

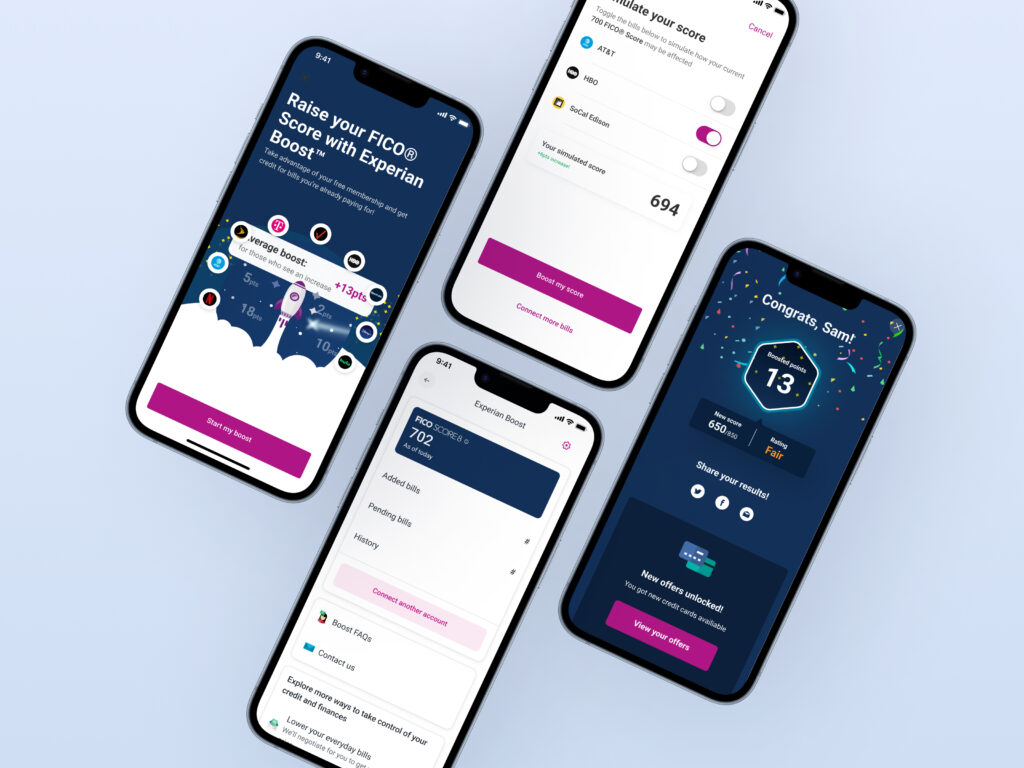

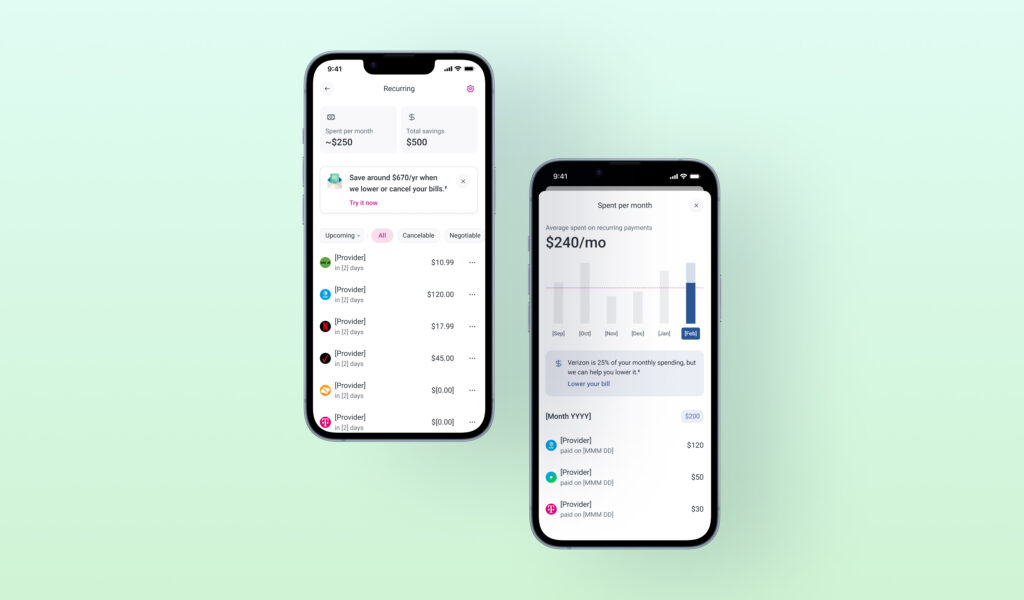

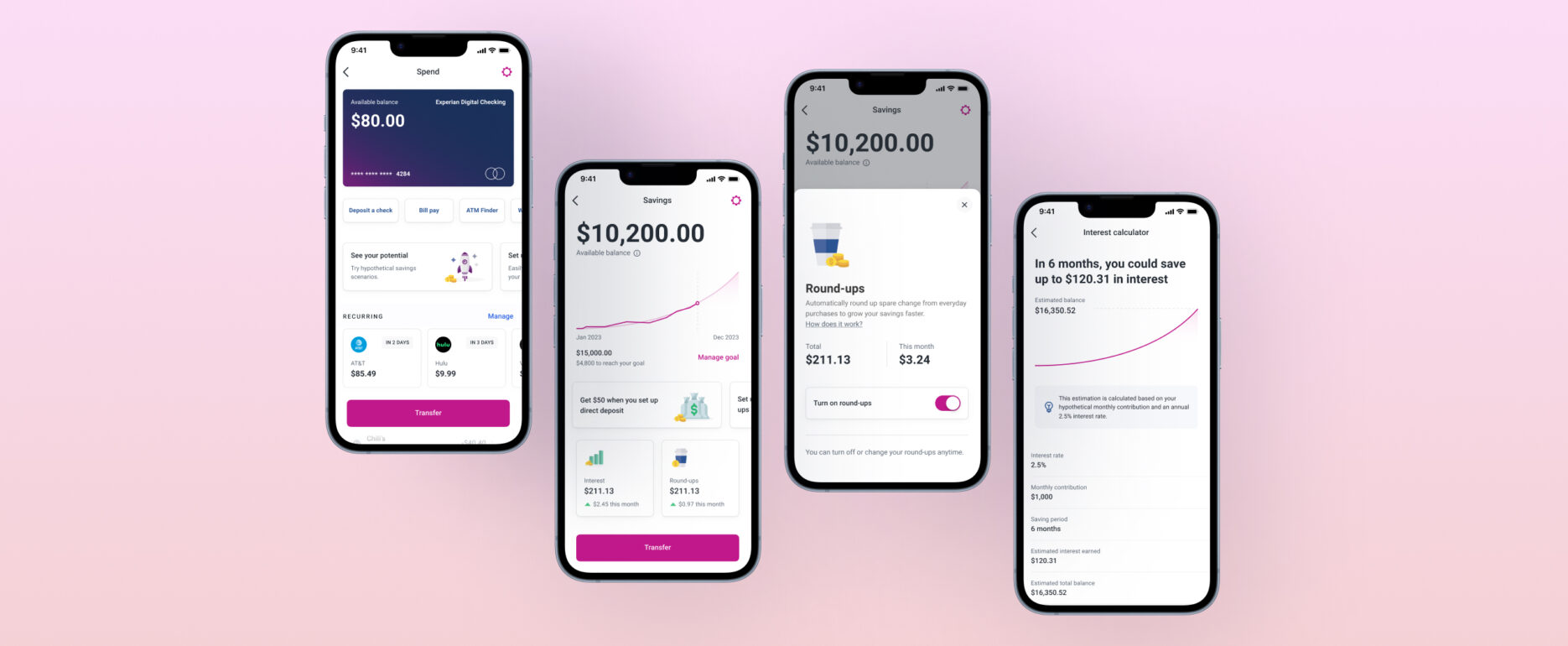

As a Senior Product Design Manager, I led the design of Experia Smart Money (ESM) — a neo banking experience helping users build and strengthen credit without incurring debt. Our goal was to empower users to take control of their financial future through transparent credit-building tools, real-time insights, and educational resources.

The challenge was to make credit building feel intuitive, rewarding, and approachable, bridging the gap between traditional credit systems and users seeking financial independence.

Design challenges

Financial Education Accessibility

Credit-building concepts can be complex. We needed to simplify these processes with clear visuals and contextual education, ensuring users understood how their behaviors affected their credit growth.

Trust & Transparency

As a new kind of financial product, establishing trust was critical. We focused on designing clear communication touchpoints, emphasizing security, transparency, and control over user data.

Engagement & Retention

The main challenge was convincing users to switch their existing bank accounts to Experian. Many users were hesitant to move their primary financial activities to a new platform. We focused on building credibility through transparent communication, clear onboarding guidance, and trust-driven design patterns that demonstrated Experian’s security, reliability, and long-term value.

Technical Constraints

We had to work within Experian’s existing data ecosystem, API structures and a banking partner, balancing innovation with compliance and scalability.

My approach

User-Centric Discovery

Conducted interviews and co-design sessions with first-time credit builders to uncover behaviors, motivations, and anxieties around credit and banking. These insights informed our design principles for simplicity, reassurance, and education.

Intuitive Design

Developed a clean, guided onboarding flow and modular dashboards showing users how their actions directly impacted credit growth. Visual cues and progress meters turned abstract financial data into tangible feedback.

Collaboration

Partnered closely with product, engineering, compliance, and marketing teams to ensure design feasibility and brand consistency. Regular workshops aligned our goals across teams and stakeholders.

Prototyping & Validation

Created interactive prototypes to test key flows like onboarding, progress tracking, and education modules. Iterations were refined through usability testing and behavioral analytics.