Stay on top of your bills

Recurring transactions

Year

2024

Client

Experian

Objective & Context

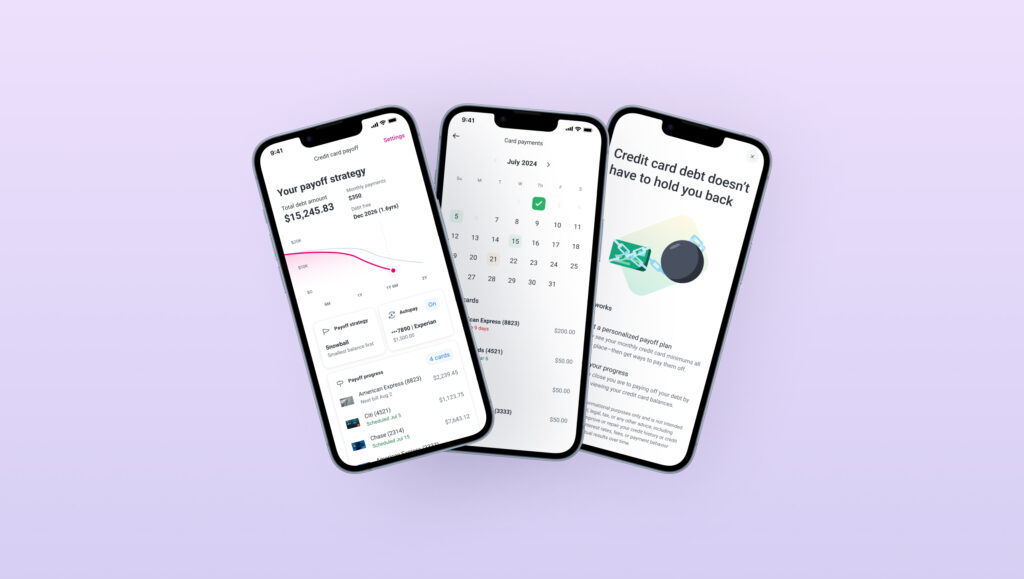

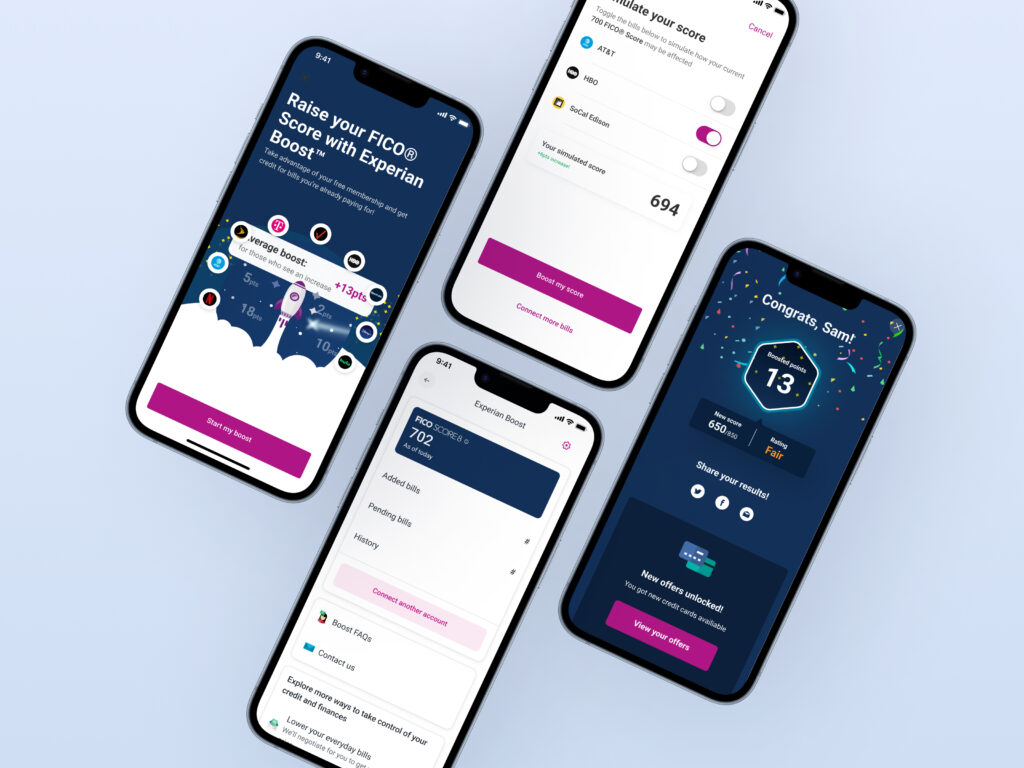

As a Senior Product Design Manager, I led the design efforts and strategy for integrating an innovative recurring payment and income identification feature into Experian’s Personal Financial Management (PFM) tool. Our objective was to empower users by providing clear visibility and actionable controls over recurring financial transactions, bill negotiations, subscription cancellations, and Experian boost.

Design challenges

Expense Tracking

Creating an intuitive method for users to effectively monitor and manage recurring expenses, balancing detailed insights with an effortless user experience to prevent cognitive overload.

Pricing Transparency

Enhancing clarity around ongoing service costs to help users identify inflated or unnecessary charges. Designing transparent displays and intuitive notifications to facilitate informed decision-making.

Subscription Overspending

Developing smart, proactive mechanisms to help users quickly identify unused or forgotten subscriptions. Ensuring users can confidently manage or cancel these subscriptions without complex interactions.

Financial Simplification

Simplifying the overall financial management experience by proactively identifying savings opportunities. Ensuring solutions are straightforward, engaging, and aligned with users' daily financial habits.

My approach

User-Centric Discovery

Conducted user research and identified pain points related to subscription fatigue and unclear recurring expenses.

Intuitive Design

Created simple and transparent prompts for user actions, clear dashboards to visualize recurring transactions, negotiations in progress, and subscriptions status.

Collaboration

Worked closely with product, engineering, and data analytics teams to ensure a seamless and accurate user experience.

Prototyping & Validation

Iteratively developed prototypes, tested user journeys, and refined the designs based on extensive user feedback.